Make Smart Loan Decisions with Precise EMI Calculations

Are you planning to take a loan but feeling overwhelmed by the complex calculations involved in understanding your monthly payments? Whether you’re considering a home loan, car loan, or personal loan, figuring out the exact EMI amount and total interest can be confusing and time-consuming when done manually.

Many people struggle with loan planning. They can’t easily compare different loan options. It’s hard to understand how interest rates, loan amounts, or tenure changes affect their monthly budget. Online calculators on websites help, but they can be slow and clunky—especially when comparing multiple scenarios quickly.

The challenge gets worse at a bank or dealership. You’re under pressure to make quick loan decisions. Sales reps may be waiting. You might have to rely on others for calculations or deal with confusing formulas. That can lead to poor financial choices—and impact your budget for years.

What if your Android device could become a comprehensive loan calculation tool that helps you make informed financial decisions with confidence? This article explores effective loan planning strategies and introduces you to a solution designed for people who want to take control of their financial future.

Common Loan Planning Frustrations

When people try to plan their loans, they often face common challenges. These can make financial decisions feel harder than they should be. Understanding these hurdles shows why the right calculation tools matter so much.

Many potential borrowers struggle with understanding how different loan parameters affect their monthly payments and total interest burden. Without clear visibility into these relationships, it’s difficult to optimize loan terms or choose the most affordable option among multiple offers.

Another widespread issue involves comparing loan offers from different lenders, where varying interest rates, processing fees, and tenure options make it challenging to determine which option provides the best value. Users commonly find themselves confused by marketing claims and unable to verify which loan actually costs less over the complete repayment period.

Additionally, many people experience difficulty in planning their budget around loan payments, particularly when they need to factor in other monthly expenses and determine how much EMI they can comfortably afford. Without proper planning tools, it’s easy to overcommit to loan payments that strain monthly budgets.

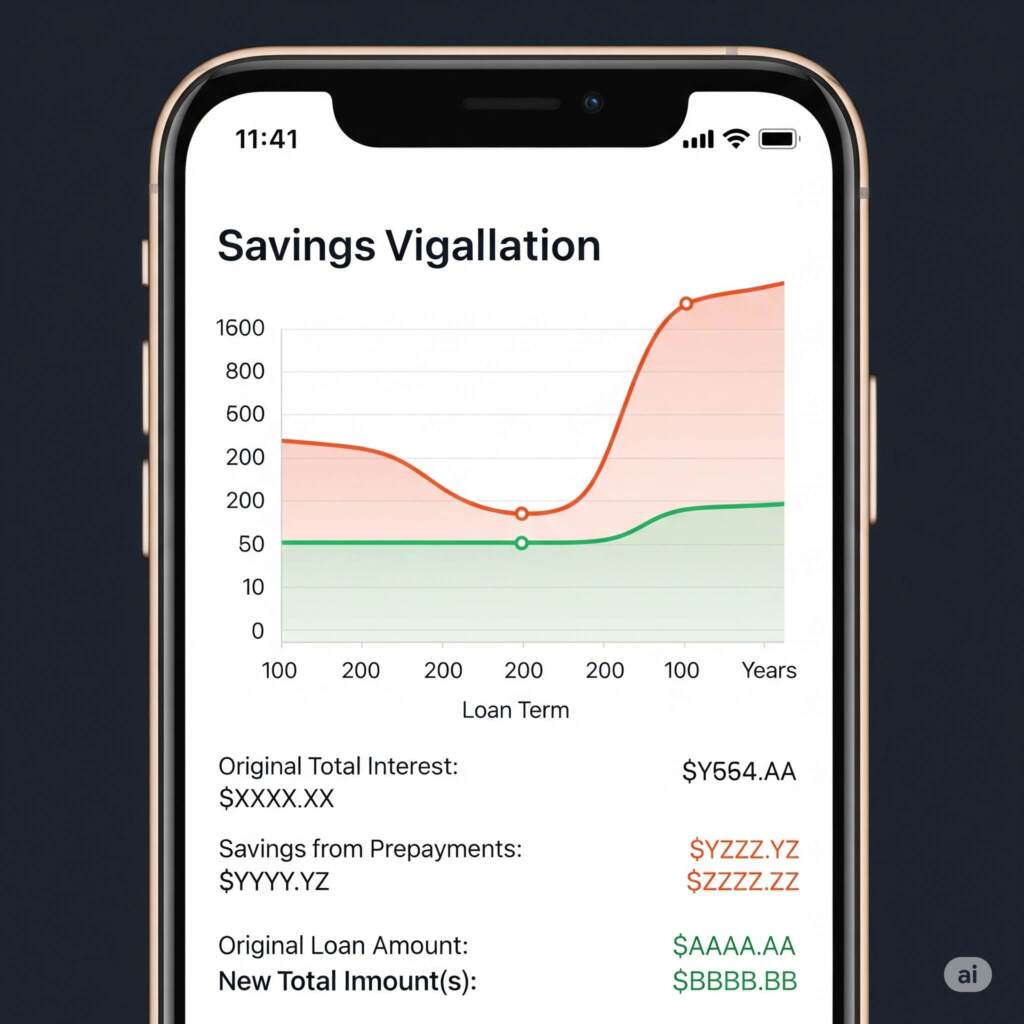

Furthermore, understanding the impact of prepayments and part-payments on loan tenure and interest savings requires complex calculations that most people find challenging to perform manually. This lack of clarity often prevents borrowers from making strategic decisions that could save thousands in interest payments.

Finally, many existing calculation tools lack the flexibility to account for different loan types, variable interest rates, or special conditions that might apply to specific loan offers. This limitation makes it difficult to get accurate projections for real-world loan scenarios. This is where a correct Android EMI Calculator can come to rescue!

EMICalculator was developed specifically to address these common financial planning challenges, providing a comprehensive solution that makes loan decision-making feel clear and confident.

7 Practical Ways to Use Your Android EMI Calculator

1. Compare Multiple Loan Offers Instantly

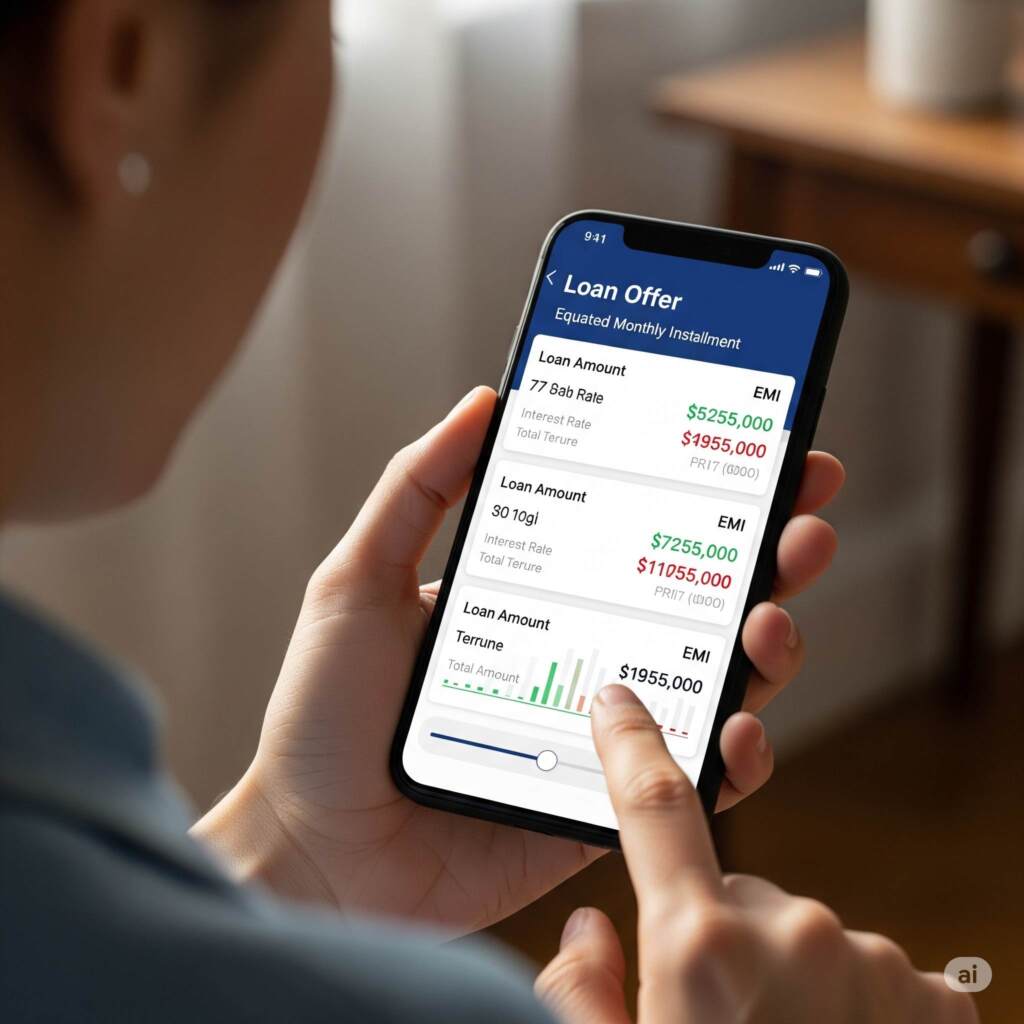

When evaluating loan options from different banks or financial institutions, having the ability to quickly calculate and compare EMI amounts helps you identify the most affordable option. Imagine being able to input different interest rates, loan amounts, and tenures to see exactly how much each option will cost over the complete repayment period. Having instant comparison capabilities truly makes the difference between choosing based on marketing promises and making data-driven financial decisions.

2. Plan Your Budget Around Loan Payments

Effective budgeting requires understanding how loan payments will fit into your monthly expenses and ensuring you can comfortably afford the commitment. Picture being able to calculate EMI amounts for different loan scenarios and immediately see how they impact your available income. When you have clear visibility into payment obligations, financial planning becomes more confident and sustainable.

3. Optimize Loan Amount and Tenure

Finding the right balance between loan amount, tenure, and monthly payments requires testing different combinations to find what works best for your situation. Having a tool that allows you to experiment with various parameters helps you discover the optimal loan structure that meets your needs without overstraining your budget.

4. Calculate Pre-payment Benefits and Savings

Understanding how additional payments affect your loan can help you save significant amounts in interest over time. Imagine being able to calculate exactly how much interest you’ll save by making extra payments or how much your tenure will reduce with prepayments. That kind of strategic planning truly makes the difference between paying standard interest and optimizing your loan for maximum savings.

5. Evaluate Loan Affordability Before Applying

Before committing to a loan application, it’s essential to ensure that the monthly payments fit comfortably within your budget constraints. Having a calculator that helps you determine the maximum loan amount you can afford based on your income and expenses prevents overcommitment and financial stress.

6. Plan for Variable Interest Rate Scenarios

Many loans come with variable interest rates that can change over time, affecting your monthly payments and total interest burden. Picture being able to calculate how rate changes will impact your EMI and plan accordingly for potential payment increases. When you have tools to model different rate scenarios, you can make more informed decisions about loan products.

7. Document and Share Loan Calculations

When discussing loan options with family members or financial advisors, having clear, professional calculations helps facilitate informed discussions and decision-making. Imagine being able to save and share detailed EMI breakdowns that show exactly how different loan options compare in terms of monthly payments and total cost.

Discover the Difference with EMICalculator

EMICalculator represents a comprehensive approach to loan planning that addresses the real challenges people face when trying to make informed financial decisions about borrowing. Unlike other basic online Android EMI Calculator that provide limited functionality, this solution delivers the accuracy and flexibility needed for serious financial planning.

We understand the confusion of complex loan terms, the stress of making large financial commitments, and the frustration of tools that don’t provide the detailed insights you need for confident decision-making. EMICalculator provides the clear, accurate calculations you need, complete with comprehensive comparison features and detailed payment breakdowns.

The app’s professional design ensures that whether you’re planning a home purchase, car loan, or personal financing, you’ll have access to the calculation tools that make every financial decision more informed and help you optimize your loan terms for the best possible outcome.

Find EMICalculator on Google Play Today!